MDM vs. CDP for Customer Master Data Management

Every executive believes they have a customer data problem. Most are solving the wrong one.

Your CFO sees financial risk inconsistent records creating billing errors and compliance nightmares.

Your CMO sees lost revenue unable to personalize because data arrives too late. Your CIO sees chaos dozens of systems each claiming customer truth. They're all right, but they need fundamentally different solutions.

Customer MDM and CDP aren't competing products. They're purpose-built machines solving opposite problems with the same asset: your customer master database. Both promise to deliver effective customer master data management, but through radically different approaches.

MDM (Master Data Management) answers:

"Which customer record can we trust in court, on financial statements, and across enterprise systems?"

It's the backbone of regulatory compliance, governance, and transactional integrity. This is customer master data management built for control and accuracy.

CDP (Customer Data Platform) asks: "Can we act on what this customer just did right now?" It thrives on behavioral data, real-time activation, and marketing speed.

The million-dollar mistake?

Buying software based on vendor promises rather than understanding which problem is killing your business. One system prevents disasters. The other drives growth. Knowing which battle you're fighting determines everything.

Customer MDM: The Traditional Master Data Approach

What is Customer MDM Designed For?

Customer MDM emerged from enterprise IT departments with a focused mandate: establish authoritative control over master data entities.

It functions as the system of record for customer information, prioritising cataloguing, governance, and ensuring every record adheres to defined standards.

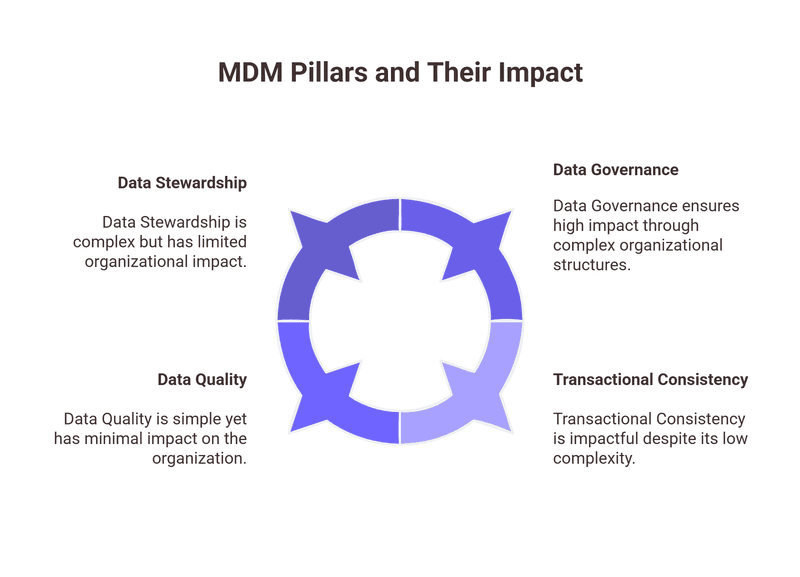

Four Core Pillars of MDM:

- Data Governance – Defines ownership rights, modification permissions, and approval workflows for customer data across the organisation.

- Data Quality – Ensures records meet established standards for completeness, accuracy, and consistency through systematic validation.

- Data Stewardship – Assigns designated personnel with accountability for maintaining data integrity within specific business domains.

- Transactional Consistency – Guarantees reliable propagation of customer information updates across all integrated enterprise systems.

The Golden Record Advantage

MDM’s core strength is creating a single, authoritative golden record for every customer.

It resolves data conflicts across systems for example, ERP shows a 50,000 credit limit while CRM shows 75,000; MDM decides using predefined rules.

This makes MDM crucial for organisations where customer master data management influences financial reporting, compliance, and complex B2B structures.

The Limitations in the Age of Agility

The same architecture that makes MDM stable also makes it slow.

Most MDMs rely on batch updates (nightly/hourly), which worked in traditional sales cycles but fail in today’s real-time digital experiences.

Customers expect instant personalization MDM simply can’t keep up.

Behavioural Data Integration Challenges

Modern customers generate hundreds of behavioural events per session.

MDM was built for structured data (names, addresses, transactions), not high-volume behavioural signals.

This mismatch leads to data integration issues, delayed processing, and broken real-time use cases.

Organizational Agility Constraints

Adding new data sources requires heavy IT lift: scoping, custom integrations, and change management.

Fast-moving marketing teams adopt new tools frequently MDM becomes a bottleneck.

Strong governance ensures quality but also slows innovation, creating friction between IT and business teams.

Customer Data Platforms (CDP): The Marketing-Centric Solution

What is a CDP Built to Do?

Customer Data Platforms emerged from a distinct challenge—marketing technology teams requiring immediate access to actionable customer data. While MDM asks "Is this data perfect?", CDP asks "Can I use this data right now?"

Unified Customer Profiles with Behavioural Intelligence

CDPs unify identity, transactions, and high-volume behavioural data (clicks, app interactions, email engagement, social activity).

Turns static records into dynamic intent-driven profiles.

Real-Time Marketing Activation

The core purpose of a CDP: instant activation.

Cart abandoned → retargeting in seconds.

Pricing page viewed multiple times → sales alerted immediately.

Data → action without delay.

Continuous Identity Resolution

CDPs stitch anonymous + known identifiers in real time.

Profiles update continuously across devices and channels no batch processing.

Its Relationship with Customer Master Data Management

CDPs perform customer master data management, but with a fundamentally different operational philosophy. Where MDM prioritizes governance and absolute accuracy, CDP prioritizes completeness and velocity. A CDP delivers an 80% accurate profile available for marketing immediately rather than waiting for a 100% accurate profile after extensive validation.

This approach doesn't indicate negligence toward data quality. Modern CDP platforms incorporate identity resolution algorithms, deduplication logic, and data quality validation. However, these capabilities serve marketing activation objectives rather than enterprise governance mandates. The CDP's version of a golden record optimizes for personalization and segmentation effectiveness, not financial reporting accuracy or regulatory compliance requirements.

MDM vs. CDP on Criteria Comparison

Feature | Customer MDM | Customer Data Platform (CDP) |

|---|---|---|

Primary Goal | Data Governance, Compliance, Transactional Integrity | Marketing Activation, Personalization, Unified Customer View |

Data Focus | Identity, Attributes, Structured Transactional Data | Behavioral, Identity, Unstructured, and Structured Data |

Data Speed | Batch Processing, Near Real-Time | True Real-Time (Event-Driven) |

Key Users | IT, Data Governance, Compliance | Marketing, RevOps, Customer Success |

Solving Data Integration Challenges | Integrates core systems (ERP, CRM) via ETL/APIs; focus on cleanliness | Integrates all sources (Web, Mobile, MarTech) via APIs/Webhooks; focus on activation |

Achieving Customer Master Data Management | The primary goal (governance perspective) | A necessary function performed to enable activation (marketing perspective) |

Implementation Timeline | 6-18 months typically | 1-3 months for basic functionality |

Flexibility | Rigid, requires IT involvement for changes | Self-service, marketers can add sources |

Cost Structure | Large upfront investment, long-term contracts | SaaS model, scales with usage |

The table reveals a fundamental truth: these systems optimize for different outcomes. Customer MDM treats data integration challenges as a governance problem requiring careful architecture and oversight. CDPs treat the same challenges as an activation problem requiring speed and flexibility.

Checkout the Customer Data Management: Benefits, Types, and Key Challenges

When to Use Which: Aligning Architecture with Strategy

Decision Criteria | Choose Customer MDM | Choose CDP |

|---|---|---|

Primary Strategic Driver | Governance, compliance, and risk mitigation | Marketing agility and revenue growth |

Industry Context | Highly regulated industries (financial services, healthcare, insurance) | Digital-first businesses (e-commerce, SaaS, media, D2C brands) |

Regulatory Requirements | HIPAA, financial regulations, audit trails, regulatory compliance reporting mandatory | Marketing performance and customer experience optimization prioritized |

Organizational Complexity | Large B2B enterprises with complex account hierarchies, multiple subsidiaries, multi-entity structures | B2C or simple B2B models with streamlined customer relationships |

Core System Integration | Customer master database must serve ERP, billing, financial reporting, accounting systems | Integration with marketing technology stack (email, ads, analytics, personalization) |

Data Quality Priority | 100% accuracy required for financial reporting, legal obligations, transactional consistency | 80% accuracy sufficient if available immediately for marketing activation |

Processing Architecture | Batch processing (nightly/hourly) aligns with monthly invoicing, quarterly reporting | Real-time, event-driven architecture for millisecond-level responsiveness |

Primary Data Types | Structured transactional data (demographics, addresses, purchase history, contracts) | Behavioral data (clickstream, email engagement, mobile interactions, social activity) |

User Base | IT, finance, operations, compliance teams requiring centralized governance | Marketing, customer experience, sales teams needing self-service capabilities |

Change Velocity | Stable data requirements; formal change management acceptable | Rapid tool adoption (quarterly); new platforms require immediate integration without IT bottlenecks |

Time-to-Value | Months to quarters; extensive planning and governance setup required | Weeks; rapid deployment and immediate marketing impact |

Key Capabilities | Golden record management, data governance frameworks, stewardship, audit trails | Unified customer profiles, segmentation, personalization, audience activation |

Data Integration Issues Solved | Consistency across enterprise transactional systems (ERP, CRM, finance) | Marketing technology fragmentation; dozens of disconnected tools |

Success Metrics | Data accuracy, compliance adherence, audit readiness, system consistency | Marketing performance, conversion rates, personalization effectiveness, campaign velocity |

The Partnership Approach: Best of Both Worlds

System | Role in Integrated Architecture | Key Responsibilities |

|---|---|---|

Customer MDM | System of Record | Maintains authoritative golden record for customer identity Handles governance, compliance, regulatory reporting Integrates with core transactional systems (ERP, finance, billing, CRM) Ensures data quality for legal and financial requirements |

CDP | System of Engagement | Consumes authoritative identity data from MDM Adds behavioural data layers and real-time interaction tracking Enables marketing activation, personalization, audience orchestration Provides self-service capabilities for marketing teams |

Combined Value | Enterprise Excellence | Solves data integration challenges across all organizational levels IT maintains governance through MDM; marketing drives agility through CDP Eliminates governance-versus-speed tension Customer master data management rigor + real-time marketing activation |

Making the Right Choice: Strategy Over Features

The decision between Customer MDM and CDP isn't really about feature checklists or vendor capabilities. It's about your organization's strategic priorities and the customer experience you're building.

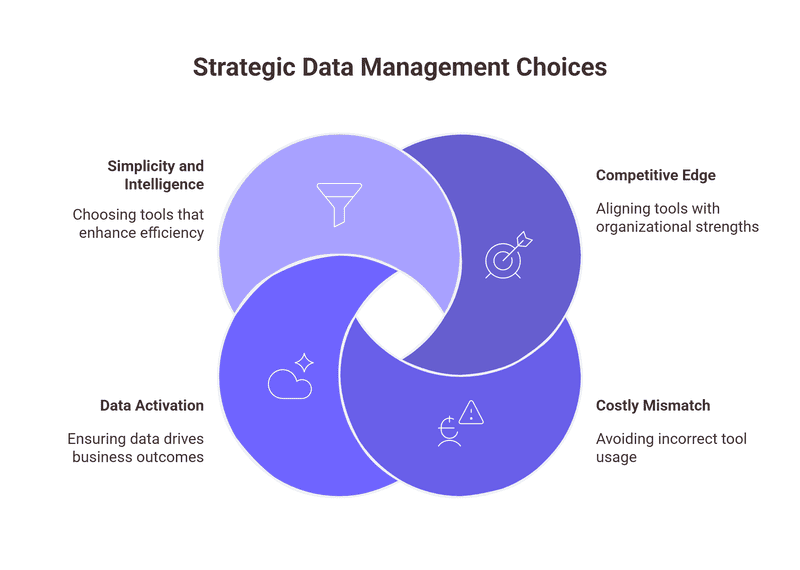

1. Know Your Competitive Edge

If your strength is operations, compliance, or complex customer hierarchies, MDM is your foundation.

If you win through personalization, speed, and marketing agility, a CDP clears the data integration challenges blocking your growth.

2. Avoid the Costly Mismatch

The real mistake?

Using the wrong tool for the wrong job.

A CDP is not a governance system.

MDM is not a marketing activation engine

Trying to force either into the wrong role guarantees years of frustration.

3. Your Data Should Actually Work

Your customer master database shouldn’t be a dusty compliance artifact—it should actively power better decisions, better experiences, and better revenue outcomes.

4. Choose Simplicity, Build Intelligence

Pick the tool that reduces complexity, not adds to it.

That’s how you create a real-time customer intelligence engine that helps your business thrive, not just survive.