The State of Revenue Growth 2026 : AI Strategies for High-Growth Enterprises

Look, I'm not here to sugarcoat this. While you're still debating whether AI is "ready for prime time," some companies just reported 1.7x revenue growth and 1.6x EBIT margins.

They're not smarter than you. They're just moving faster!!

Half of CEOs believe their job is literally on the line if AI doesn't pay off in 2026. That's not pressure that's survival mode.

Want a reality check? OpenAI went from $200 million in revenue (early 2023) to $13 billion annualized by August 2025. Anthropic? Even more insane $87 million to $7 billion. That's an 80-fold increase. In two years.

These aren't flukes. They're what happens when you build revenue models around AI instead of bolting AI onto broken processes.

The brutal truth?

Only 30% of CEOs feel confident about revenue growth in 2026 down from 56% in 2022.

The gap between winners and losers isn't narrowing. It's exploding.

So here's the question: Is your revenue team adapting conversational revenue orchestration, or are they about to become a case study in what not to do?

Let's break down what's actually working in 2026. No fluff. Just the plays that are printing money right now.

Conversational Revenue Orchestration Just Became Non-Negotiable!

First things first. If you're still running siloed sales tools, you're toast.

Gartner just created a whole new category called Revenue Action Orchestration (RAO), and they named Clari a Leader and Salesloft a Visionary in their first Magic Quadrant. This isn't incremental. It's a complete reimagining of how revenue teams operate.

Think about it. Your reps are jumping between Salesforce, Gong, HubSpot, Outreach, and twelve other tools. Every handoff is a potential revenue leak. Every context switch costs time.

Companies with integrated AI-powered conversational revenue orchestration deliver 50% better customer acquisition performance and 75% more effective cross-selling. But get this only 5% of companies achieve this "future-built" status.

That gap? That's your opportunity window. But it's closing fast.

Top Tools Actually Driving Revenue in 2026

Let's talk real tools. Not buzzwords. What are winning companies actually using?

Clari is the 800-pound gorilla here. Their platform manages over $5 trillion in revenue for global enterprises. One customer reported AI helped their business grow by over 70% in bookings year-over-year, with forecast accuracy landing within 3-4% every quarter for two years straight. That's not luck. That's orchestration.

But Clari's expensive. We're talking enterprise pricing that smaller teams can't swing.

Forecastio.ai is crushing it for mid-market companies, especially HubSpot users. They're reporting up to 95% forecast accuracy with implementation in minutes after CRM connection. Fast, accurate, and cheaper?

Gong merged with insights to become a full revenue intelligence platform. The Gong Reality Platform captures and analyses customer interactions, delivering insights at scale for repeatable wins.

Salesloft just merged with Clari, creating a unified revenue orchestration monster. Post-merger, they're combining sales engagement with conversation intelligence, deal management, and forecasting.

The pattern? Consolidation. Point solutions are dying. Unified platforms are winning.

Let's talk real tools. Not buzzwords.

While enterprise tools take months to implement, Zigment.ai delivers AI-powered revenue orchestration that actually works for growing companies. We're talking conversational AI agents that qualify leads, book meetings, and nurture prospects 24/7 without the enterprise price tag.

Here's what makes Zigment different: it's built for speed.

Companies are seeing email revenue amplification , faster response times through intelligent orchestration. The AI handles initial conversations, qualifies intent, and routes hot prospects to your reps instantly.

Agentic AI Is Rewriting The Revenue Playbook

Here's where it gets exciting.

Agentic AI isn't doing what your intern does. It's doing what you wish your entire revenue team could do simultaneously across hundreds of deals.

Agentic AI revolutionized revenue operations in 2025 by automating multi-step workflows like lead scoring and deal acceleration without human prompts, achieving 45% manual task reductions and 38% faster onboarding.

Salesforce launched Agentforce, making it easier for businesses to create AI agents that handle customer service requests and warm up sales leads before passing them to humans.

Real numbers? Organizations deploying agentic AI are seeing 171% average ROI, with U.S. companies hitting 192%.

But here's the thing. These agents need clean data. They need unified systems. They need orchestration.

See how everything connects?

What Companies MUST Update Right Now?

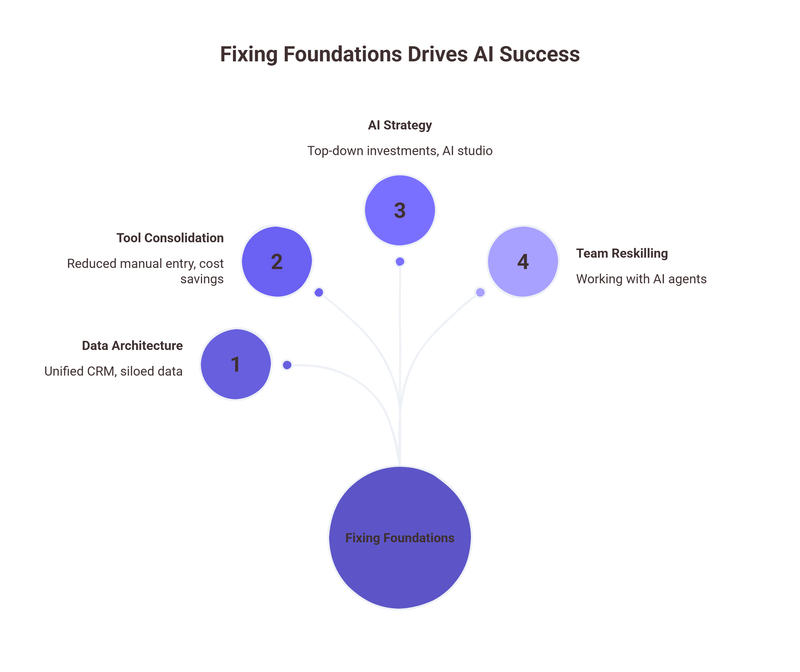

Stop adding tools. Start fixing foundations.

1. Data Architecture

Your CRM is probably a mess. Your data is siloed. Your AI can't work miracles with garbage inputs.

Revenue orchestration requires combining information from sales, marketing, and customer success into a single unified system. Not next quarter. Now.

Companies are losing 80% of response time just because their data isn't orchestrated properly. That's literally money evaporating.

2. Tool Consolidation

Look at your tech stack. How many require manual data entry?

The platform consolidation decision isn't just about replacing tools—it's about whether your organization will be among the 5% capturing compounding advantages or part of the majority deploying AI without bottom-line impact.

Brutal, but true.

Companies are moving and seeking cost reduction with unified platforms. The savings are real.

3. AI Strategy (For Real This Time)

Instead of crowdsourcing AI initiatives, successful companies use top-down programs where senior leadership picks focused AI investments looking for key workflows where payoffs can be big.

You need an AI studio. A centralized hub with reusable tech components, frameworks for assessing use cases, a sandbox for testing, and deployment protocols.

65% of CEOs say accelerating AI is one of their top three priorities, and corporations expect to double their AI spending in 2026 from 0.8% to about 1.7% of revenues.

If you're not allocating real budget, you're not serious.

4. Team Reskilling

Your team needs to learn how to work with AI agents, not compete against them.

Companies should expect to free up 20% of their people's time to allow them to build competence, learn to apply AI to real work, and build solutions.

Short-term pain? Maybe. But the alternative is watching your best people leave for companies that are investing in their AI capabilities.

Predictive Analytics: The Numbers Game You Can't Ignore

Tools providing anomaly detection that cuts forecasting errors by 50% in RevOps stacks.

Think about that. Half your forecasting errors. Gone.

Predictive analytics dominated 2025 AI revenue growth, using ML for hyper-accurate demand forecasting and personalized upselling, boosting conversions 32%.

Companies using ZoomInfo are tracking over 1 billion signals across web activity, job postings, and technology changes to identify accounts actively researching solutions.

This isn't guesswork anymore. It's signal processing at scale.

The Orchestration Advantage Nobody Talks About

Here's what most companies miss. Orchestration isn't just about efficiency. It's about intelligence propagation.

Revenue orchestration enables a true partnership between human insight and AI-driven action, where sales professionals approve, edit, or reject AI-generated plans, then the system executes, reports back, and evolves based on outcomes.

It's a learning loop. Every deal. Every interaction. Every signal.

LeanData gets this. Their platform connects every buying signal to the right sales action, intelligently routing leads with full buyer context to the right rep.

The companies winning in 2026 aren't just automating. They're building systems that get smarter every day.

Revenue orchestration isn't a feature. It's the foundation!

Agentic AI isn't hype.

The gap between leaders and laggards is widening every quarter.

Companies establishing unified data and orchestration foundations now will deploy autonomous agents at scale. Everyone else? They'll still be struggling with fragmented tools.

2026 is your moment. The tools exist. The playbooks are proven. The ROI is real.

Time to stop experimenting and start executing.