CXO-Ready Dashboard HubSpot Can’t Build: See Why Deals Are Lost, Fix It

The boardroom question sounds simple. It never is.

“Show Me Why We Lost” is the moment every CXO waits for and the moment most HubSpot dashboards fail. You can pull activity logs, email opens, stage durations, and attribution charts in seconds. What you can’t show is the actual reason the deal died. The missed objection. The ignored pause. The moment the buyer disengaged and no one noticed.

Here’s the uncomfortable truth: HubSpot records what happened, but struggles to explain why it happened in that order. And when you can’t explain loss, you can’t fix it. This article explains why a CXO-ready dashboard that HubSpot can’t build is now a RevOps requirement and how to build it safely on top of your existing systems.

Why “Show Me Why We Lost” Breaks Most HubSpot Dashboards

Ask HubSpot to explain a lost deal and it will oblige but not in the way a CXO expects. You’ll get charts, timelines, and activity counts by channel. What you won’t get is causality.

Most HubSpot dashboards answer operational questions:

How many emails were sent?

Which channel had the highest engagement?

How long did the deal stay in each stage?

A CXO asks something very different:

What signal mattered most?

Where did buyer confidence drop?

Which decision or non-decision changed the outcome?

HubSpot summarizes events, not meaning. It treats every touchpoint as equal and channels in isolation. Context flattens. Intent disappears.

“Deals are rarely lost due to missing data. They’re lost when the story behind that data falls apart.”

Once that story breaks, explaining loss turns into guesswork instead of insight.

The Familiar Failure Pattern in Modern HubSpot Programs

We see the same pattern across teams and industries. A prospect engages with an email, replies with a pricing question, switches to WhatsApp asking for a comparison, a sales rep acknowledges, promises to follow up, and automation keeps running.

Every interaction is logged. HubSpot did exactly what it was told. The problem appears between steps. Context doesn’t carry forward. The system can’t see that urgency dropped, objections remain open, or trust weakened.

The result:

Follow-ups ignoring live objections

Channel switches that reset conversations

Buyers repeating themselves

Reps reacting instead of guiding

“When conversations reset, trust erodes faster than pipeline.” By the time the deal is marked lost, the signals were already there; the system just didn’t connect them.

The Revenue Cost of Not Knowing Why You Lost

When teams can’t explain loss, pipeline slows first. Win rates soften. Forecasting feels optimistic instead of reliable. Teams default to surface-level explanations:

“Pricing was the issue.”

“The buyer went dark.”

“We lost to a competitor.”

These labels feel comforting but they’re incomplete. The chain of events is missing: the unanswered objection, delayed follow-up, or channel switch. These moments decide outcomes.

The downstream cost adds up:

Reps repeat mistakes across deals

Managers coach on outcomes instead of behaviors

RevOps optimizes volume while leaks remain untouched

“If loss can’t be explained clearly, improvement becomes accidental.” Revenue performance stays reactive instead of controlled.

From Rules to Decisions: Reframing the Problem

Most HubSpot programs run on rules: if this happens, do that. Rules are predictable, but blind. They don’t pause when urgency drops or a rep says, “Let’s hold off for a week.” The system keeps moving because the rule says so.

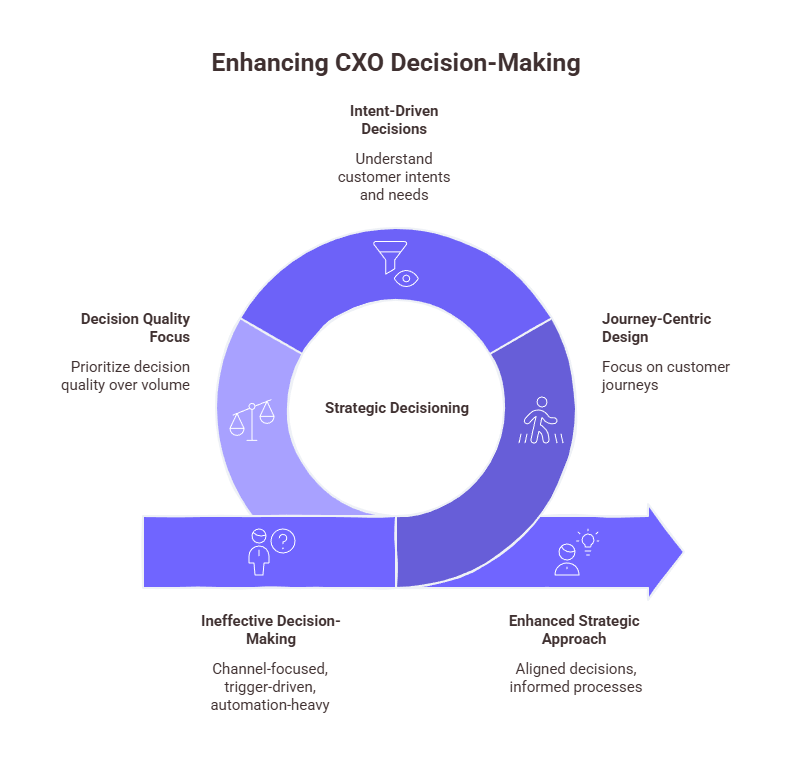

CXOs need decisioning. This shifts design from:

Channels → journeys

Triggers → intent

Automation volume → decision quality

A decision-aware system considers context, past responses, and team goals, then recommends or executes the next best move. Without reasoning, dashboards can’t explain outcomes. With decisions, “why we lost” becomes traceable.

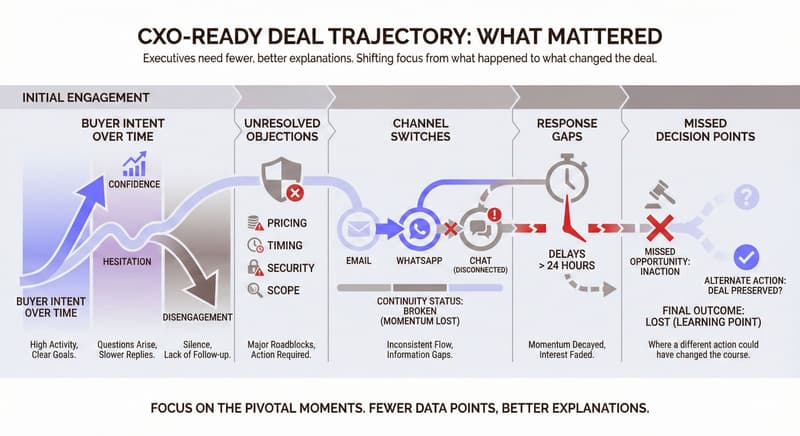

What a CXO-Ready “Why We Lost” Dashboard Actually Shows

A CXO-ready dashboard doesn’t impress with volume. It highlights moments that changed the deal’s trajectory, shifting focus from what happened to what mattered.

At minimum, it surfaces:

Buyer intent over time — signals of confidence, hesitation, and disengagement

Unresolved objections — pricing, timing, security, or scope

Channel switches — email → WhatsApp → chat, with continuity status

Response gaps — delays that allowed momentum to decay

Missed decision points — where a different action could have preserved the deal

“Executives don’t need more data. They need fewer, better explanations.”

The output reads like a narrative, not a spreadsheet. Trust weakens, urgency fades, and the journey stalls become visible. Conversations change, coaching becomes specific, and improvement repeatable.

The Safe Path Forward: A Stateful Layer on Top of HubSpot

Ripping out HubSpot isn’t realistic or necessary. Add a layer above HubSpot that observes, remembers, and reasons across everything it already captures.

Keep HubSpot as the System of Record:

Store contacts, deals, and activities

Power sales, marketing, and service workflows

Serve as a source of truth for reporting and compliance

Add State and Memory Where It’s Missing:

Connect conversations across email, chat, WhatsApp, SMS, and calls

Carry forward objections, pauses, and intent signals

Recognize when buyer situations change

Enable Safer, Smarter Orchestration:

Automations adapt instead of blindly firing

Reps get guidance grounded in the full journey

Leaders gain confidence in what the data says

“Execution scales fast. Understanding needs structure.” This keeps HubSpot intact while making loss explainable.

Concrete Playbook: How to Build This on Top of HubSpot

1. Unify Signals Across Channels

Stop treating channels separately. Bring together email, website chat, WhatsApp, SMS, calls, and support tickets. Continuity matters more than volume.

2. Create a Conversation Graph

Preserve memory: open objections, buyer intent shifts, explicit pauses, and commitments. This allows the system to understand state, not just sequence.

3. Define Goals Before Automations

Be explicit about outcomes: book a qualified demo, resolve pricing concerns, re-engage stalled deals. Actions serve goals, not workflows.

4. Introduce Next Best Action Logic

Decisioning becomes possible: recommend when to wait, switch channels, or escalate human follow-up. Orchestration replaces noise.

5. Add Governance and Human-in-the-Loop

Approval gates, audit trails, and human override keep execution safe. The result is control without slowdown.

What to Measure Once You Can Finally See “Why We Lost”

Decision-quality metrics replace volume metrics:

First response time across channels — tracks how quickly teams respond to context changes

Objection resolution rate — how often concerns are explicitly closed

Qualified lead to demo booked rate — early decisioning alignment with buyer intent

Stalled-deal recovery rate — context-aware follow-ups restart momentum

Retention and expansion signals — reveal fragility in post-sale conversations

“What you can explain, you can improve.” Once aligned, loss becomes a feedback loop, not a post-mortem.

Conclusion: Answering the CXO Question with Confidence

Every leadership team asks: Show me why we lost. Zigment adds a stateful, agentic layer on top of HubSpot to answer that clearly. Persistent memory via a Conversation Graph, goal-driven Next Best Action, and true omnichannel continuity combine with governance and human-in-the-loop controls.

The outcomes are practical and measurable:

Higher qualified-lead and demo-booked rates

Faster, context-aware first responses

Stronger retention driven by continuity

When loss is explainable, improvement stops being guesswork. It becomes a system.