Conversation Intelligence Software: The Features Checklist You Actually Need

Your sales team records 500 calls a month. Your support team logs thousands of chat interactions. Your customer success team has back-to-back Zoom meetings.

And yet, when you ask "Why did we lose that enterprise deal?" or "What's causing the spike in churn?"

The answer is buried somewhere in those recordings, inaccessible and useless.

Here's the uncomfortable truth: most conversation intelligence software is just an expensive filing cabinet. It records, transcribes, and stores. But it doesn't understand. It can't detect urgency in a prospect's voice or spot the exact moment a customer signals they're ready to buy.

The gap between collecting conversational data and actually using it to drive revenue is where most companies are stuck.

Let's fix that.

What Conversation Intelligence Software Should Actually Do

Real conversation intelligence software doesn't just document what was said—it extracts what matters and triggers what comes next.

Think of it this way: you don't need a tape recorder. You need a behavioural analyst who listens to every conversation, identifies patterns, flags critical signals, and immediately alerts the right person to take action.

That's the difference between passive recording and active intelligence.

The intelligence layer matters more than the recording layer. If you're evaluating tools, start there.

Want to see how real-time signal extraction works in practice? Let's talk about building intelligence into your conversational data.

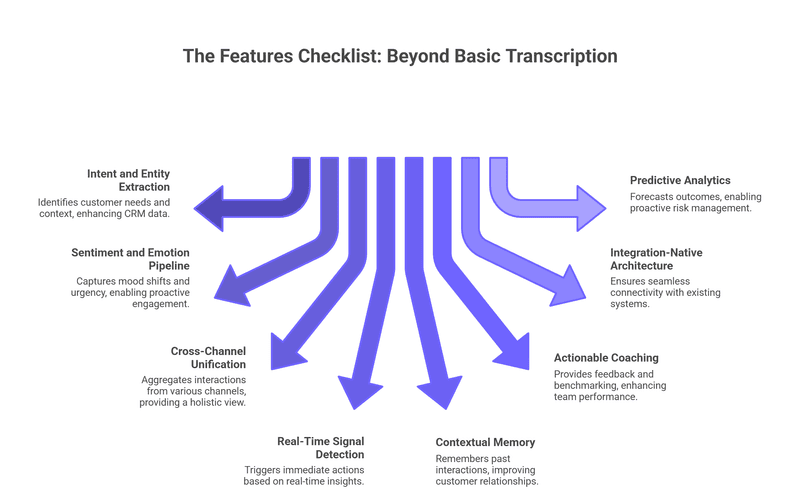

The Features Checklist: Beyond Basic Transcription

Most conversation intelligence platforms advertise the same surface-level capabilities. But if you're a RevOps leader trying to eliminate information silos and build a single customer view, you need to dig deeper.

Here's what to look for:

1. Intent and Entity Extraction (Not Just Keywords)

Your tool should identify what the customer wants and who or what they're talking about.

Does it recognize buying signals? ("We need to have this implemented by Q2.")

Can it tag specific product mentions, competitor names, or feature requests?

Does it distinguish between exploratory questions and decision-stage conversations?

Sales call analysis software that only highlights keywords like "pricing" or "demo" isn't smart enough. You need a system that understands context and extracts entities that map directly to your CRM fields.

2. Sentiment and Emotion Pipeline

This is where most tools fail spectacularly. They'll tell you a call was "positive" or "negative" based on crude word matching. But customer sentiment is rarely that simple!

Your conversation intelligence platform should capture:

Mood shifts during the interaction (frustration turning into relief, confusion turning into confidence)

Urgency levels that indicate deal velocity or churn risk

Emotional patterns across multiple touchpoints that reveal customer health scores

Extracting these qualitative signals is what allows you to move from reactive support to proactive engagement. A customer doesn't need to say "I'm frustrated"—the tool should detect it and route the conversation accordingly.

3. Cross-Channel Unification

Here's where conversational intelligence tools prove their value: they break down information silos.

If your sales calls live in one platform, your support chats in another, and your email exchanges in a third, you don't have conversation intelligence—you have conversation chaos.

The right platform should:

Aggregate interactions from calls, chats, emails, and video meetings into one unified view

Build a conversation history for each customer that spans every channel

Surface patterns that only become visible when you connect the dots across touchpoints

Customer interaction analysis only works when you're analyzing all interactions, not just the ones from a single tool.

4. Real-Time Signal Detection and orchestration

This is the difference between conversation intelligence software and a glorified note-taking app.

When a high-value prospect mentions they're "comparing options and need to decide this week," what happens next?

Does the system automatically flag the account as high-priority?

Does it trigger an alert to the account executive?

Does it update the deal stage in your CRM?

Does it add the prospect to a targeted nurture sequence?

Revenue-focused autonomous actions should be the end goal. The intelligence you extract is only valuable if it drives immediate, automated responses that move deals forward or prevent churn.

5. Contextual Memory Across Time

Your customers don't interact with you in isolated episodes. They have ongoing relationships with your brand. So why does your conversation intelligence platform treat every interaction like it's the first one?

Look for tools that:

Remember what was discussed three calls ago and surface relevant context automatically

Track how a customer's needs, objections, and sentiment evolve over weeks or months

Connect the dots between what sales promised and what support is now hearing

Without contextual memory, you're forcing your teams to manually piece together customer history before every interaction. That's not intelligence that's busywork.

6. Actionable Coaching and Performance Insights

The best sales call analysis software doesn't just score calls—it makes your team better at their jobs.

Your platform should deliver:

Specific, actionable feedback tied to conversational patterns (talk-to-listen ratio, question quality, objection handling)

Benchmarking against top performers so reps know exactly what "good" looks like

Automated identification of coaching moments without managers needing to review every call manually

Generic dashboards that show "call volume" and "average sentiment" aren't coaching tools. They're vanity metrics.

7. Integration-Native Architecture

If your conversation intelligence platform requires manual exports, custom API work, or "partner integrations" to connect with your CRM, marketing automation, or customer data platform, run.

You need a system that's built for interoperability from day one:

Bi-directional sync with your CRM (not just one-way data dumps)

Native webhooks that trigger workflows in your existing stack

Standard data models that make it easy to feed conversational signals into your analytics layer

The whole point of conversational intelligence tools is to eliminate information silos. If the tool itself becomes another silo, you've solved nothing.

8. Predictive Analytics and Risk Scoring

Here's where conversation intelligence software moves from descriptive (what happened) to predictive (what's likely to happen next).

Advanced platforms should be able to:

Predict which deals are at risk of stalling based on conversational engagement patterns

Identify churn signals before customers explicitly express dissatisfaction

Score leads based on buying intent signals extracted from early-stage conversations

This is the difference between reacting to problems and preventing them. If your tool can only tell you what already happened, you're always going to be one step behind.

Zigment's Conversation Graph™ doesn't just record history it predicts what comes next and triggers the right actions before you lose the opportunity.

Why Most Tools Can't Deliver on This Checklist

Legacy platforms were built for compliance and coaching—not for orchestration. They record sales calls so managers can review them later. They transcribe support chats so you can audit quality.

But they weren't designed to extract fuzzy constructs like mood, urgency, and intent. They definitely weren't built to trigger multi-step workflows based on conversational signals.

That's an architecture problem, not a feature gap. Here's why most tools fall short:

1. They're Built on Recording Infrastructure, Not Intelligence Infrastructure

Most conversation intelligence platforms started as call recording tools with AI features bolted on later. The core architecture is designed to capture and store audio files, not to process conversational signals in real time.

You can't retrofit true intelligence onto a system that was designed to be a digital filing cabinet. The data models, processing pipelines, and storage layers are fundamentally wrong for what modern revenue teams actually need.

2. They Lack the NLP Sophistication to Extract "Fuzzy" Constructs

Detecting keywords is easy. Understanding that a customer's tone shifted from confident to hesitant halfway through a pricing discussion? That requires advanced natural language processing models trained specifically on sales and support conversations.

Most platforms use generic sentiment analysis models that were trained on product reviews or social media posts. They don't understand the nuance of B2B buying conversations, the subtle objections hidden in "I need to think about it," or the difference between polite interest and genuine intent.

3. They're Siloed by Design

Legacy tools were built when "conversation intelligence" meant "sales call analysis." They weren't designed to handle chat transcripts, email threads, SMS exchanges, and video meetings in a unified way.

Even when vendors claim "multi-channel support," what they usually mean is separate modules that don't actually talk to each other. You end up with conversation intelligence for calls, separate analytics for chats, and nothing that connects them into a single customer view.

4. They Don't Have Workflow Orchestration Capabilities

Recording platforms are read-only by nature. They generate insights that humans then have to act on manually. They weren't architected to do anything with the intelligence they extract.

True orchestration requires bidirectional integration with your entire revenue stack, sophisticated rules engines, and the ability to trigger complex, multi-step workflows based on conversational signals. Most platforms stop at "send a Slack notification" and call it automation.

5. Their Data Models Can't Support Contextual Memory

To remember context across time and touchpoints, you need a graph-based data architecture that represents relationships between conversations, customers, topics, and outcomes.

Most conversation intelligence platforms store transcripts as flat documents in a database. That's fine for search and retrieval, but it's fundamentally incapable of answering questions like "How has this customer's attitude toward our pricing changed over the last six interactions?" or "What topics keep coming up across all conversations with enterprise prospects?"

6. They Optimize for Backward-Looking Analytics, Not Forward-Looking Action

The key performance indicators that legacy platforms were designed around are all lagging indicators: call volume, talk time, keyword mentions, average sentiment scores.

What revenue teams actually need are leading indicators that predict what's about to happen and prescriptive actions that tell you what to do about it. That requires predictive models, risk scoring algorithms, and recommendation engines that most platforms simply don't have.

This is exactly why we built Zigment differently from the ground up as an agentic intelligence layer, not a recording tool with AI features tacked on.

Your Next Move

If you're evaluating conversation intelligence platforms, start with this question: "What happens after the conversation is recorded?"

If the answer is "someone can search it later" or "we generate reports," keep looking.

The right tool extracts intent, detects emotion, breaks information silos, and triggers autonomous actions all in real time. That's the checklist that matters.

And if you want to see what that actually looks like in practice, we'd be happy to show you.